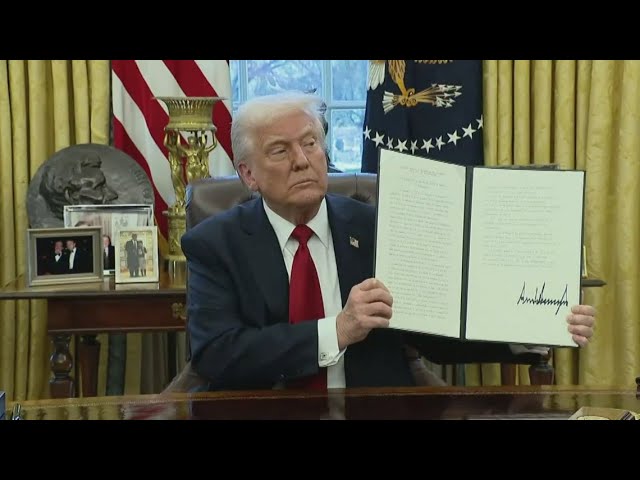

President Donald Trump announced Wednesday a sweeping new tariff policy that will impose a 25% duty on all imported cars, including passenger vehicles, SUVs, minivans, cargo vans, and light trucks. The move, set to take effect April 3, marks a significant escalation in the global trade war and has raised concerns about its impact on consumers, automakers, and the broader economy.

“I think our automobile industry will flourish like it hasn’t before,” Trump said during remarks from the Oval Office.

In addition to finished vehicles, the new tariffs will apply to key imported auto components, including engines, powertrain systems, and electrical parts. While the auto tariffs take effect April 3 at 12:01 a.m., tariffs on imported auto parts will be rolled out by May 3, according to a White House proclamation.

The White House fact sheet released alongside Trump’s announcement argues that excessive reliance on foreign-made cars and parts poses a threat to U.S. national security.

“The U.S. auto industry is vital to national security and has been undermined by excessive imports threatening America’s domestic industrial base and supply chains,” the fact sheet said.

Currently, the U.S. imposes a 2.5% tariff on passenger car imports and a 25% tariff on imported pickup trucks. This latest action marks the most expansive set of tariffs targeting the auto sector to date.

The administration noted that roughly half of the 16 million vehicles sold in the U.S. last year were imported. Of those assembled domestically, only about 50% of the components were made in the U.S., the fact sheet claims.

“Of the 16 million cars bought by Americans, only 25% of the vehicle content can be categorized as Made in America,” the White House stated.

Trump’s announcement follows recent market volatility sparked by earlier rounds of tariffs on steel, aluminum, and other imports. Economists and industry leaders have warned that additional tariffs could drive up car prices, disrupt supply chains, and stifle investment.

Several U.S. automakers have urged caution, emphasizing the global nature of the car manufacturing industry, where parts are often sourced from multiple countries—even for vehicles built in the U.S.

While the administration frames the move as part of its broader effort to rebalance trade and revive domestic manufacturing, critics argue it could further inflame tensions with key trading partners, including the European Union, Japan, Mexico, Canada, and South Korea, all of whom export large volumes of vehicles and auto parts to the United States.

The auto industry, trade analysts, and global markets now brace for the next phase of what Trump has dubbed a strategy to reclaim “economic sovereignty” for America.