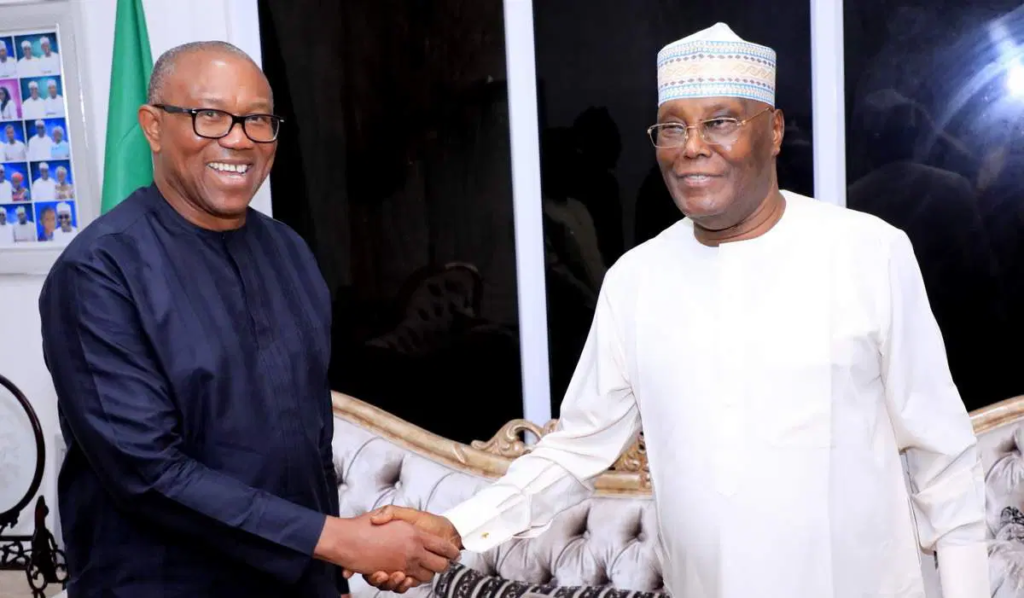

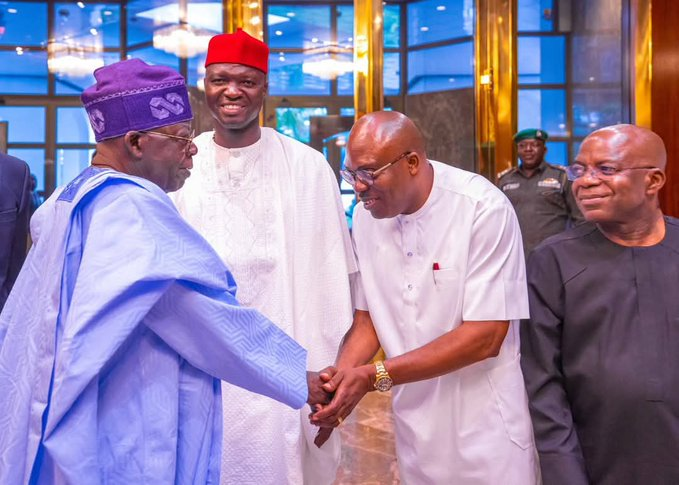

Former Vice-President Atiku Abubakar has condemned President Bola Tinubu’s new borrowing proposal, describing it as “reckless, dangerous,” and a threat to Nigeria’s economic stability and the well-being of future generations.

In a post on X (formerly Twitter) on Thursday, Atiku reacted to Tinubu’s May 27 request to the National Assembly seeking approval to borrow over $21.5 billion in external loans and issue ₦757.9 billion in bonds to clear outstanding pension liabilities.

Atiku warned that the proposed borrowing would push Nigeria’s public debt from ₦144.7 trillion to ₦183 trillion over 60% of the country’s total foreign exchange reserves further tightening the nation’s already fragile fiscal position.

“Since President @officialABAT assumed office in 2023, public debt has jumped by 65.6%. Under the APC-led administration since 2015, it has ballooned by 1,048%, from ₦12.6 trillion to ₦144.7 trillion,” he stated.

He noted that Nigeria’s debt-to-GDP ratio now exceeds 50%, while the debt-service-to-revenue ratio has risen to an alarming 130%, meaning the country spends more repaying loans than it generates in revenue.

“This government is not borrowing for development it is borrowing to service existing loans. This is a debt spiral, not a growth strategy,” Atiku said. “Public finance has turned into a Ponzi scheme borrowing to pay debt, then borrowing again to pay interest.”

Calling the move an act of “economic sabotage,” the former vice-president urged civil society organizations, the media, lawmakers, and the international community to intervene, warning that Nigeria is heading toward “debt slavery.”

In response to rising criticism, the Ministry of Finance insisted that the proposed borrowing would not “automatically” lead to a debt increase—an assertion Atiku dismissed as misleading and inconsistent with Nigeria’s current debt trajectory.

Atiku’s remarks underscore mounting anxiety over the nation’s debt profile, with critics warning that without urgent and responsible fiscal reforms, Nigeria risks mortgaging its future to service past excesses.