Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has highlighted that a significant portion of Nigeria’s Value-Added Tax (VAT) is paid by low-income earners. During a Senate briefing on Wednesday, Oyedele shared plans to overhaul the tax system, including exempting essential goods and services such as education, healthcare, transportation, and accommodation from VAT to alleviate the financial strain on the poor.

“We have proposed in the bill before you to remove VAT on these essential items,” Oyedele said, noting that 82% of VAT comes from consumption by low-income earners, who primarily spend on basic necessities.

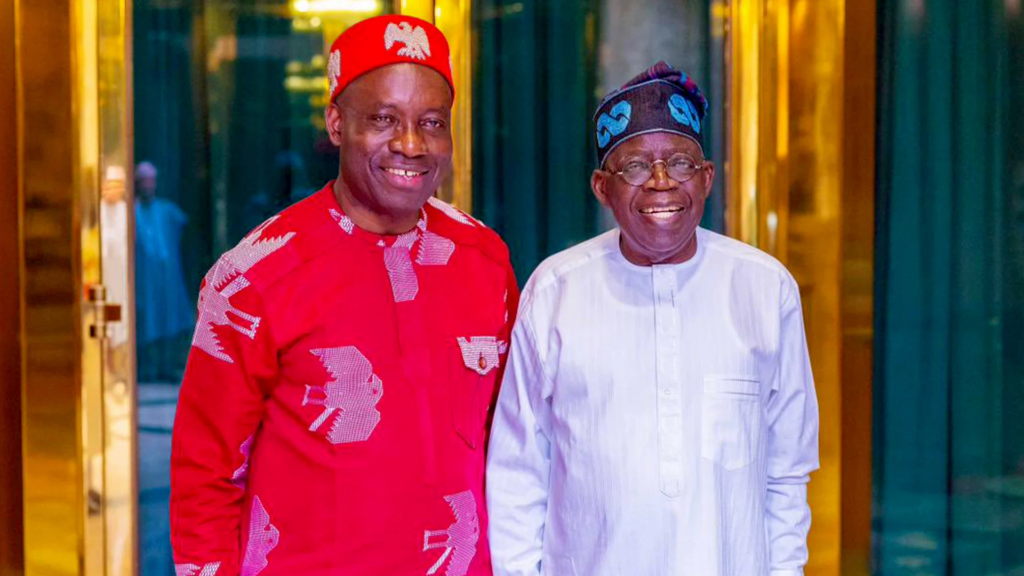

The reforms are part of four tax bills submitted to the National Assembly by President Bola Tinubu two months ago, aiming to create a more progressive tax system. While VAT will remain on non-essential items, Oyedele emphasized that “four out of every five consumptions by the masses will no longer carry VAT.”

Although the proposed reforms have received some criticism, Oyedele defended them, stressing that the changes are designed to foster a more business-friendly environment, especially for small enterprises. He criticized the current tax laws for impeding business efficiency, saying, “It is almost like a crime for you to want to restructure your businesses to be efficient.”

Oyedele also drew attention to the heavy tax burden on small businesses, including VAT, withholding tax, and various local levies, advocating for an increase in the threshold to protect them from these financial obligations.

In conclusion, Oyedele reiterated that the proposed tax reforms aim to strike a balance between meeting government revenue needs and supporting the welfare of the public and businesses essential to Nigeria’s economic growth.