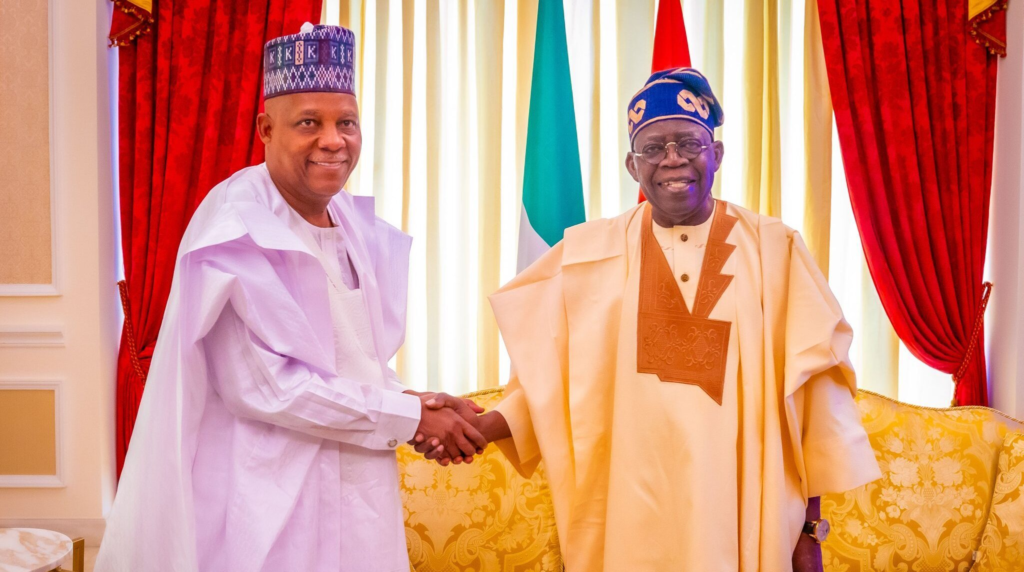

The presidency has revealed that the administration of President Ahmed Bola Tinubu is working on measures to support the Naira.

At the “Cowries to Cash” lecture and lunch in Abuja on Tuesday, Dr. Tope Fasua, Special Adviser to the President on Economic Matters, disclosed this.

In recent days, the value of the Naira has steadily increased, and Fasua said that this trend is expected to continue due to government measures being put in place.

While noting that a country’s currency declining in value is a sign of conquest, he said “When you want to destroy a country, destroy its currency first.”

He cautioned Nigerians who are hoarding foreign currencies with the hope that the local currency would continue to fall, warning that the policies of the government would shock them.

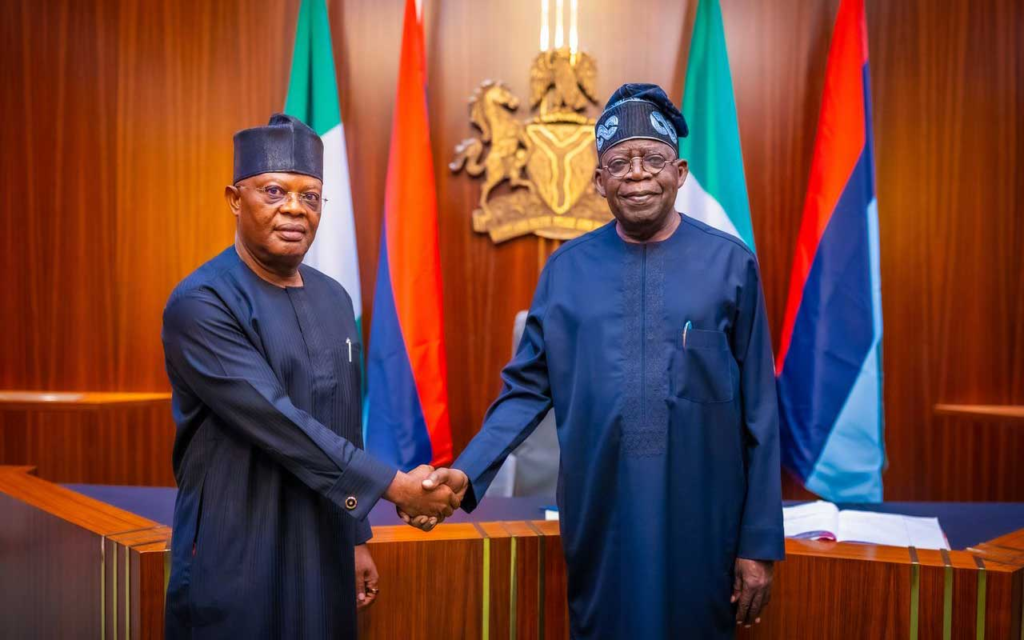

Fasua who represented the Vice President, Kashim Shettima, at the event said: “For those who are speculating and praying and wishing that the currency would become nonsense, I believe that the policies are being rolled out by the central bank and the government that I serve, led by the President, will shock some of them.

“You need to listen to the agenda, the man himself (Tinubu) and you will see that the level at which he is thinking is far ahead of most of us.

“You know, he has some very great ideas coming up. Some of them are what you’ve seen reversing the fall in the value of the naira, but he has also challenged us to review forward many of the targets, for example, the idea that Nigeria’s economy will get to a trillion dollars. He wants to achieve it by 2026.

“Some people thought that the naira would continue to lose value. Of course, we can already see what’s going on and who knows, maybe the Naira will strengthen even further to maybe something 500 or 600. I’m beginning to see some of those.”

“If you want to position your exports properly, you have to be strategic, even in terms of the value of your currency. So you’re going to see all of these, including efforts from the fiscal side.

“We have patriots running the economy right now. And naysayers have to be very, very afraid,” Fasua said.

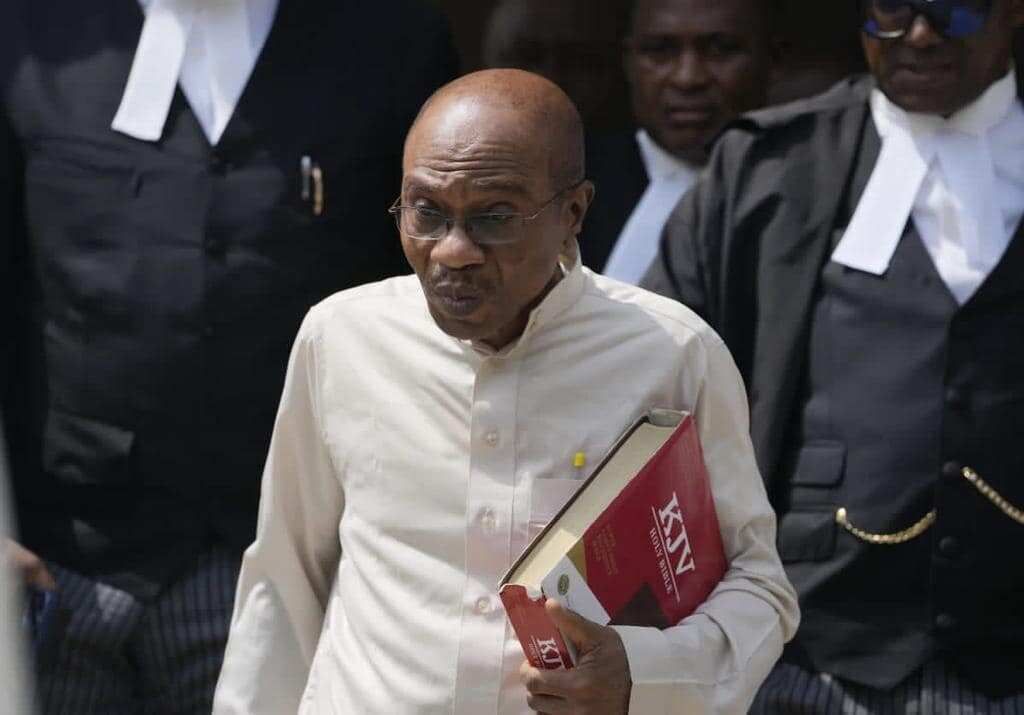

In his keynote address at the event, the Governor of the Central Bank of Nigeria (CBN) Dr Olayemi Cardoso, who was represented by the Director of Banking Supervision, Mr. Mustapha Haruna, said the country was going through economic challenges occasioned by a number of macroeconomic issues linked to some of the lingering impacts of the COVID-19 pandemic and the ongoing Russia-Ukraine war.

The CBN Governor said the book (Cowries to Cashless) would eloquently capture the evolutionary journey in the history of the CBN particularly with regards to the phenomenal transformation of the Nigerian payment system in the last two or three decades.

This transformation, Cardoso noted, has been deepened by the implementation of the cashless policy.

“One of our strategic priorities in this effort is to foster financial inclusion and I’m very sure you will also relate to the progress we have made based on the current numbers.

“We have financial inclusion in the neighbourhood of about 64 per cent. Over 64 per cent of Nigerians have access to formal financial services. Our vision is to push the boundaries to over 95 per cent and we are well on course, in achieving that objective.”

Cardoso assured that the CBN would continue to collaborate with the key stakeholders, particularly the fiscal authorities to ensure that it addressed a number of the essential issues and challenges currently facing the country.

Ada Peter