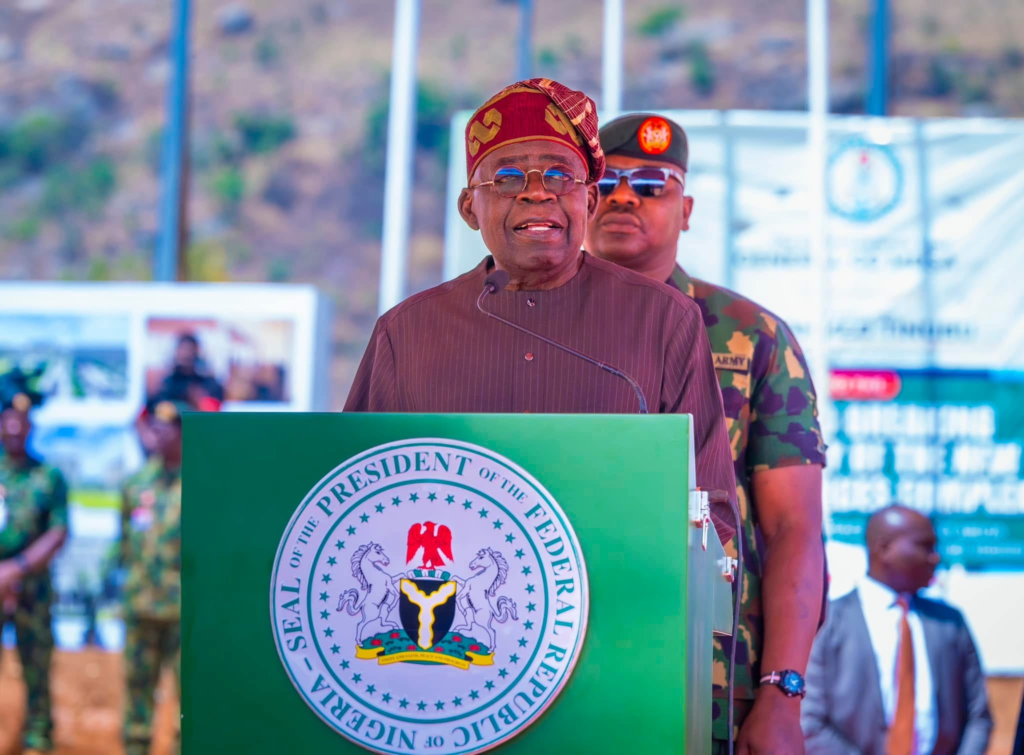

The Nigerian Senate on Wednesday passed two of the four contentious tax reform bills submitted by President Bola Ahmed Tinubu, retaining the current 7.5% Value Added Tax (VAT) rate.

The passage followed the presentation and adoption of a report by the Senate Committee on Finance, chaired by Senator Mohammed Sani Musa (APC, Niger East), during plenary.

The four tax reform bills under consideration were:

- Joint Revenue Board (Establishment) Bill, 2025

- Nigeria Revenue Service (Establishment) Bill, 2025

- Nigeria Tax Administration Bill, 2025

- Nigeria Tax Bill, 2025

However, only the Nigeria Revenue Service (Establishment) Bill, 2025, and the Nigeria Tax Administration Bill, 2025, were passed on Wednesday.

Initially introduced in November 2024, the bills faced intense debate, delaying legislative progress. The Senate subsequently engaged in extensive consultations with critical stakeholders, including state governors, to secure support for the reforms. Major opposition came from northern political elites and civil society groups, particularly over VAT-related clauses.

One of the key decisions adopted was the VAT distribution formula:

- State governments: Equality – 50%; Population – 20%; Place of consumption – 30%

- Local governments: Equality – 30%; Place of consumption – 70%

The Senate also rejected proposals to incrementally raise VAT rates, opting to maintain the existing 7.5%.

Additionally, lawmakers endorsed the continued financing of key national agencies from development levies, with the following distribution:

- Tertiary Education Trust Fund (TETFUND): 50%

- Nigerian Education Loan Fund: 15%

- National Information Technology Development Fund (NITDA): 10%

- National Agency for Science and Engineering Infrastructure (NASENI): 10%

- National Cybersecurity Fund: 5%

- Defence Security Fund: 10%

To strengthen institutional independence, the Senate approved funding for the Tax Ombud solely from the Consolidated Revenue Fund (with National Assembly approval), eliminating reliance on external gifts or grants. The Tax Appeal Tribunal will now receive funding through the national budget rather than the Federal Inland Revenue Service (FIRS).

Senate President Godswill Akpabio praised his colleagues for their dedication, noting they worked until 5:30 p.m. to pass the two bills. He assured that the remaining bills the Joint Revenue Board (Establishment) Bill, 2025, and the Nigeria Tax Bill, 2025 would be considered today.

Deputy Senate President Barau Jibrin also commended the Senate, particularly the Finance Committee and Elders Committee, for demonstrating leadership in navigating the controversial reforms.

“It is time to congratulate the entire Senate and, in particular, the Committee on Finance and the Elders Committee for the wisdom and leadership shown on these bills,” Barau remarked.