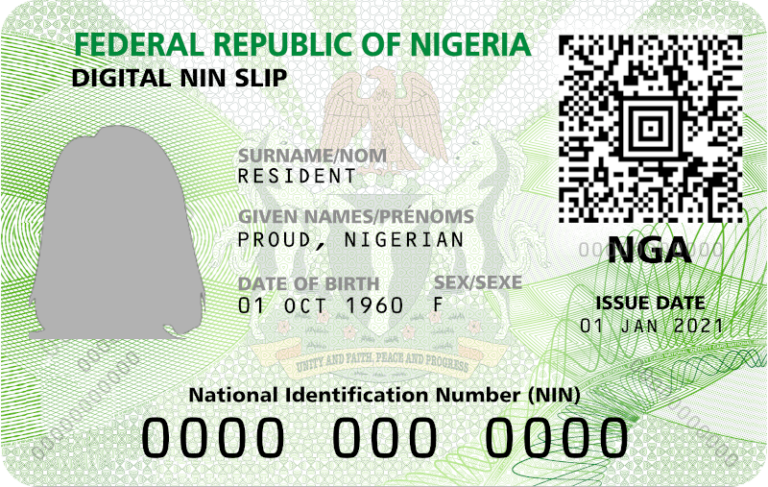

The National Orientation Agency (NOA) has announced that the Nigerian Consumer Credit Corporation (CREDICORP) is developing a centralized national credit system that will link individuals’ credit scores to their National Identification Numbers (NIN) a major move aimed at improving financial transparency and accountability in Nigeria’s lending ecosystem.

In its weekly bulletin, NOA stated that this unified credit infrastructure will enable real-time access to borrowers’ credit histories across all financial institutions, including commercial banks, fintechs, and microfinance lenders.

“This credit system will link Nigerians’ credit scores with their NIN. Credit score is a numerical representation of an individual’s creditworthiness, typically ranging from 300 to 850,” the agency explained.

Once operational, the system will serve as a risk assessment tool for lenders and improve access to credit, especially for responsible borrowers. It is also designed to deter loan defaults by making all borrowing data traceable, with consequences for non-repayment.

The development coincides with President Bola Tinubu’s launch of the second phase of the Consumer Credit Scheme, announced on June 12, and set to begin in July 2025. This phase will target 400,000 young Nigerians, including NYSC members, offering interest-free consumer loans of up to ₦2 million to qualified individuals.

The first phase of the scheme, launched in September 2023, was restricted to civil servants and offered loans of up to ₦3.5 million with annual interest rates between 2% and 4%.

“The necessity to expand access to affordable consumer credit nationwide is the rationale behind this second phase,” NOA said.

CREDICORP’s Managing Director, Uzoma Nwagba, described the project as a “fundamental shift” in Nigeria’s credit culture. He emphasized that the system will consolidate all borrowing records using a borrower’s NIN, regardless of whether the loan was obtained from traditional banks, digital lenders, or microfinance institutions.

“Whether you borrowed from a commercial bank, a microfinance institution, or a digital lender, that data will now be traceable and carry real consequences,” Nwagba said.

The new initiative is expected to foster responsible borrowing, curb loan defaulting, and stimulate consumer spending, ultimately helping the federal government achieve greater economic inclusion, financial discipline, and credit market deepening across the country.