The establishment of a Presidential Committee on Fiscal Policy and Tax Reforms has been approved by President Bola Tinubu.

Dele Alake, Special Adviser to the President on Special Duties, Communications, and Strategy, made this known in a statement in Abuja on Friday.

The establishment of the committee, according to the statement, is consistent with his promise to remove any hurdles preventing corporate growth in the country.

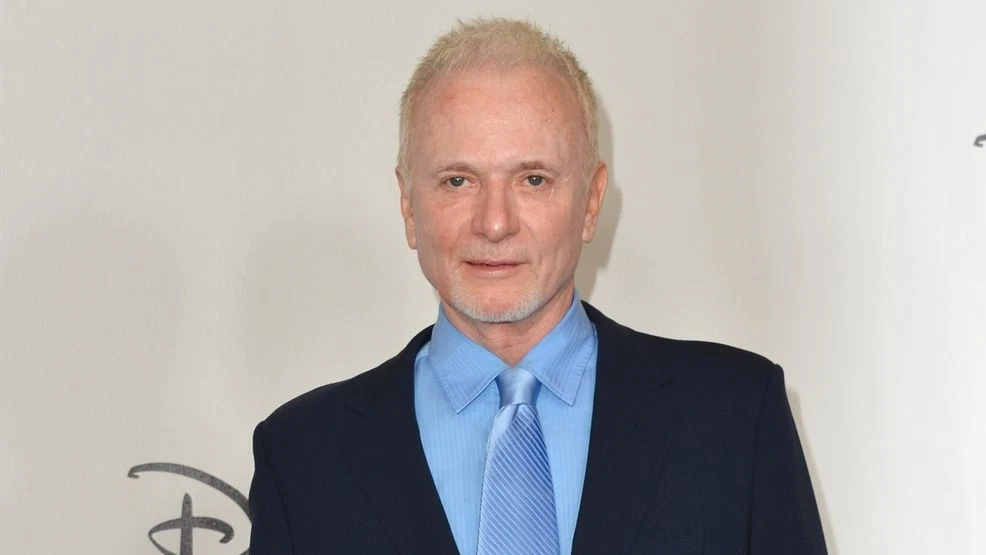

The committee will be chaired by Taiwo Oyedele, Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), according to the statement.

It will comprise experts from both the private and public sectors and have responsibility for the various aspects of tax law reform, fiscal policy design and coordination, harmonization of taxes, and revenue administration.

Oyedele’s Bio

Oyedele is an Associate Professor at Babcock University’s Business School, according to the statement.

Oyedele is the Thematic Lead for the Fiscal Policy and Planning Commission and the Chairman of the Nigerian Economic Summit Group’s West Africa Debt Management Roundtable.

He attended the London School of Economics and Political Science, Yale University, and the Harvard Kennedy School Executive Education. He is a guest lecturer at the Lagos Business School and the President and Founder of the Impact Africa Foundation.

He also chairs the Institute of Chartered Accountants of Nigeria’s Taxation & Fiscal Policy Faculty Board and is a member of the Nigerian Taxation Standards Board.

Oyedele serves as a member of the Ministerial Committee on implementing Nigeria’s National Tax Policy. He is a member of the Global Tax Forum and has previously served as a member of the Global Governing Council of the Association of Chartered Certified Accountants.

The establishment of the presidential committee comes 24 hours after President Tinubu signed four Executive Orders to curb multiple taxations as complained by a cross-section of Nigerians and the business community.

The four Orders include the suspension of the five percent Excise Tax on telecommunication services as well as the Excise Duty escalation on locally manufactured products.

The President also suspended the 2023 Finance Act 2023 deferring the date of its commencement from 28th May, 2023 to 1st of September, 2023.

Some of the suspended taxes were issued through Executive Orders by former President Muhammadu Buhari at the twilight of his administration.

They include Corporate Income tax, Import duties, Export duties, Excise duties, Rents, Capital Gains tax, Personal Income tax, Value Added tax, Stamp duties, Property tax, Licenses, Motor Parking fee, Motor Vehicle fee, Withholding tax, Land tax, Market License fee, Road tax, Business Premises, dividend tax, NHIS levy, Advert fee, Regulation fees, the new NYSC levy.

Ada Peter